Plan Your Business Exit

Develop a comprehensive strategy for transferring, selling, or closing your business. Seek the advice of professionals to ensure that all loose ends are tied up.

Closing Your Company

Deciding to close your business can be a challenging choice. The Small Business Federal Agency’s locator tool can connect you with local resources to assist you in planning your exit strategy. Seek counsel from your attorney, business valuation expert, and other business professionals such as accountants, bankers, and the IRS.

Follow these steps to close your business:

- Decide to Close: Sole proprietors can make their own decision, but partnerships require the approval of all partners. Follow your company’s articles and document them with a written agreement.

- Submit Dissolution Documents: If you don’t legally dissolve a limited liability company or corporation in the state in which it’s registered, you’ll still be subject to tax and compliance requirements. Check your state’s Secretary of State, Business Office, or Business Agency websites for more information.

- Cancel Registrations, Permits, Licenses, and Company Names: This protects your finances and reputation by eliminating any unnecessary expenses or liabilities, including your business name.

- Comply with Employment and Labor Laws: Check the Department of Labor’s Worker Adjustment and Retraining Notification (WARN) Act, along with federal and state laws, for guidance on post-layoff pay to workers.

- Resolve Financial Obligations: Settle any outstanding income and sales tax obligations, cancel your Employer Identification Number, and inform federal and state tax agencies. Use the IRS checklist for guidance on how to close your business.

- Maintain Your Records: You may be required by law to retain employment and tax records, among other documents. Follow general guidelines recommending that you keep records for at least three to seven years.

Selling Your Business

If you’ve considered all options and decide to sell your business, careful planning can help ensure a smooth transition.

Conduct a business appraisal to determine a monetary value before presenting it to potential buyers. You can take a self-assessment and learn more about business appraisal resources from the Appraisal Foundation.

Determine the value of all assets associated with your small business, including intangible assets such as brand presence, intellectual property, customer data, and future revenue projections.

Consider the following common valuation methods when calculating your business’s value:

- Revenue Method – Analyze projected revenue while accounting for potential risks.

- Market Method – Compare your business to similar businesses that have recently been sold.

- Asset Method – Subtract the company’s total liabilities from the total value of all assets.

Create a Sales Agreement

A sales agreement is required to officially sell your business. This document enables you to acquire the assets or shares of a corporation. An attorney should review it to ensure its accuracy and length.

List all inventory for sale, including the names of the seller, buyer, and company. Fill in the background. Before closing, decide how the business will be run and the level of access the buyer will have to your information. Take note of any adjustments, agent fees, and other relevant terms.

Omitting assets or responsibilities could cause issues even after the sale has been completed.

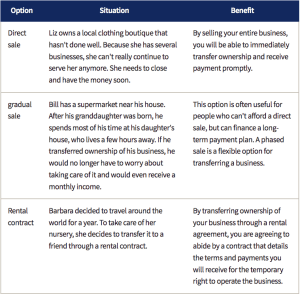

Convey Ownership

There comes a time when many small business owners need to transfer their property rights to another individual or entity. You have several options for doing so.

Additional Considerations

Transferring ownership of a family business has legal implications, including IRS-imposed gift and estate tax obligations. Property transfers may also be subject to taxation.

It’s also essential to understand how to approach your exit strategy based on your company’s type. You may want to consult with an attorney to learn about any additional rules that may apply

Consider Bankruptcy or Liquidation

In difficult times, it may be necessary to consider filing for bankruptcy or liquidating your business. This process has significant implications for your employees, assets, and tax obligations.

Throughout the bankruptcy process, it is essential to stay on top of all tax filings and payments. The Internal Revenue Service’s Online Bankruptcy Tax Guide provides useful information on debt discharge, tax procedures, and considerations for different business structures.

Liquidation of assets should only be considered as a last resort when no other buyers, mergers or successors are available. A well-planned and executed action plan is essential for this process of distributing assets to creditors and shareholders.

Before taking any action such as cancelling a lease, selling equipment, or discontinuing services, it is vital to consult with a legal and financial advisor. These professionals can help you develop a plan to present to your creditors and obtain their cooperation throughout the process.

To navigate the asset liquidation process, consider following these steps:

- Create an inventory of all assets and determine which ones to sell.

- Ensure that your merchandise is insured.

- Establish the liquidation value of assets with a certified appraiser.

- Use this value to estimate the net selling price and re-evaluate your decision.

- Choose the best type of sale, such as negotiated, consignment, online, sealed offer, or retail.

- Select the most appropriate time and location for your sale.

- Engage the services of an auctioneer, dealer, commission agent, or other expert.

- Use a non-recourse sales contract to transfer the risk to the buyer.

The Small Business Administration offers valuable resources for small business owners seeking guidance on this process.

Consider bankruptcy or liquidation as a difficult but sometimes necessary option. Throughout the process, keep up with tax filings and payments, and develop a solid action plan before taking any action. By following these steps, you can maximize the value of your assets and navigate this process with confidence.

I recommend Dreams Animation for everyone who wants to grow!

I recommend Dreams Animation for everyone who wants to grow!