Take control of your financials

One of the keys to running a successful business is having a good handle on your finances. Effective financial management involves maintaining proper bookkeeping and understanding the basics of business finance.

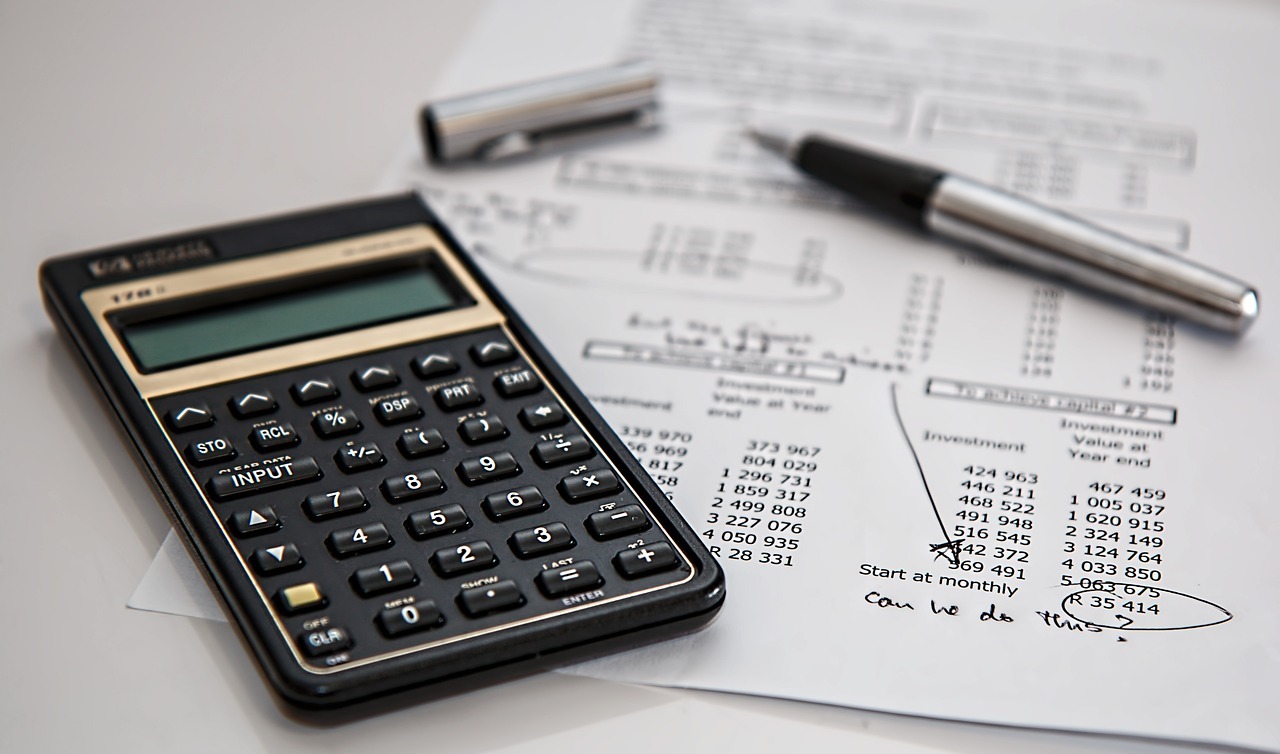

Establish a strong financial foundation

Your financial foundation is built on your balance sheet, which gives you a snapshot of your company’s financial health. It helps you keep track of your capital and projects your cash flow for the future.

The balance sheet is a powerful tool for justifying costs, such as those associated with employees and supplies. It also allows you to control assets, liabilities, and capital stock. By breaking down different segments of your business and analyzing things like online versus in-person sales, you can gain a better perspective on your finances.

Analyze costs and benefits

To maintain a healthy balance between profit and loss, it’s important to closely examine your revenue and expenses. Categorizing your expenses on your balance sheet will help you perform a cost-benefit analysis, which weighs the strengths and weaknesses of a business decision and puts potential recurring benefits and cost reductions in context.

Cost-benefit analysis is a technique for making non-critical decisions in a relatively quick and easy way. It involves adding up the total gains and total costs during a certain period, then subtracting the costs from the gains to determine the success in monetary terms. This can be useful when deciding whether to hire another employee or an independent contractor.

As an illustration, suppose you are contemplating adding a delivery service to your pizza shop, Pie Paradise. You anticipate that the new service will generate an additional $10,000 in revenue per year. However, there are costs to consider, including hiring a delivery driver, purchasing a delivery vehicle, and marketing the new service. After conducting a thorough cost-benefit analysis, you conclude that the benefits of the new service outweigh the costs, making it a sound investment for your business.

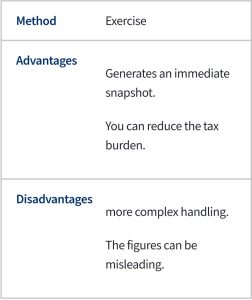

Opt for a Bookkeeping Approach

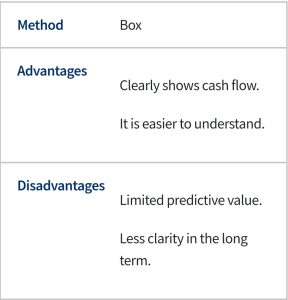

Record-keeping is an essential part of running a business. Two popular bookkeeping methods are accrual and cash. The accrual method records transactions as soon as they occur, while the cash method records them only when payment is received.

For instance, if you sell goods in January and receive payment in February, the accrual method will record it in January, but the cash method will add it to February.

GAAP and its Importance

Preparing financial statements for a small business requires proper planning. Generally Accepted Accounting Principles, or GAAP, provide a framework for standardized financial reporting using the accrual method. Private firms aren’t bound to follow GAAP. The Financial Accounting Standards Board (FASB) is responsible for maintaining GAAP in the United States.

Seek Assistance with Accounting

If you’re struggling to manage your finances, consider hiring a Certified Public Accountant (CPA), bookkeeping assistant, or utilizing an online service.

Although an accountant may be pricier than online services, they can offer customized services based on your business’s specific requirements. An accounting assistant can help with daily functions at a lower cost, but may not have the formal training of a CPA.

Ensure that whoever you choose is capable of handling the following:

- Accounts Receivable

- Accounts Payable

- Available Cash

- Bank Reconciliation

- Payroll